Our podcast on adding value to your organisation using risk management:

This month we were fortunate enough to be interviewed by Suzy Yates from The Podcast Agency. We’ve still got our regular monthly article full of insights but you can click the media file below for additional information on how you can leverage your risk management processes to add value to your organisation.

When most business owners think of risk management their mind shifts towards avoiding losses. What if I told you this is one of the biggest opportunities missed by business leaders?

Each time you view risk in your business you’re faced with the same dilemma – is this risk worth the reward. Your first instinct may be to avoid the opportunity, or pursue it, but how can you determine which will add the most value to you organisation?

Click the video below for an example of how we’re programmed to be risk averse, even when it’s not in our best interests:

In this month’s blog we look at why a top Food and Beverage company is leveraging their risk management approach to add value to their organisation, and show you how you can do the same.

Why do the best businesses use risk management to add value?

Premier Fruits Group is a great example of a business which understands both sides of the risk management equation. PFG is owned by three families and turns over around $250 million annually. PFG is currently looking to acquire companies in the Asia region where they can add value via their food safety and control processes.

According to Anthony Di Pietro, Australia’s stringent safety standards have “created disciplines and processes in the business that make us world leading in supply chain management”, allowing PFG to significantly de-risk businesses in the Asia region which haven’t conformed to the same controls. This is important for PFG because of the role risk plays in setting the value of an investment.

Risk is a key variable in the value equation

A simplified equation to value a business is:

Value = EBITDA x Risk Multiple

We focus a great deal of attention every day on the first part of this equation, but how much time do we spend on the second component, and the time we do spend, is it strategic or reactive?

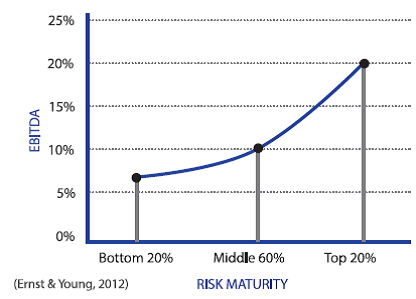

Risk management allows you to improve your organisation discount rate, making your future cash-flow more predictable. See the below graph to see how an improvement in Risk Maturity correlates to your EBITDA.

How can risk management add value to MY organisation?

Risk management allows you to more accurately value your business but what does this actually look like?

There are five areas where risk management can add greater value to your business. We will explain these five using examples from or experience with various clients in the food and beverage industry.

- Better Decisions

A major food brand had built their business based on the strong relationships in place with contract manufacturers, however had no formal contracts in place. When considering the supply chain risks associated with various interruption scenarios, they realised that agreeing contracts would ensure all parties would understand where responsibilities lie and would be able to manage these risks much more proactively, for the benefit of all parties.

- Competitive Advantage

A manufacturer was limiting the amount of credit issued to customers in order to avoid the downside of bad debts may lead to. Instead if you focus on improving credit control systems, and complement these systems with trade credit insurance, you minimise your exposure and allows you to offer longer credit terms than your peers, creating the opportunity for significant increases in sales.

- Resilience

A contract manufacturer was searching for long term commitment to invest in new equipment, so a business impact analysis was used to demonstrate the benefits of the investment in additional lines. By allowing for redundancy and having extra capacity, this provided customers with more certainty around continuity of supply and resulted in a long term engagement to supply.

- Risk Culture

Changes to safety legislation challenged the “fend-for-yourself” business model of a national franchisor. A two year commitment to a safety framework with franchisees delivered compliance, lower incident statistics, and improved relationships with franchisees, which resulted in efficiencies in the operation and better service to customers.

- Cost Reduction

A large food processing business saved over $4M in premium over 4 years via a significant investment in the risk improvement of their facilities and their operations.

What are my next steps?

Risk has a negative connotation but in business we take risks every day. The real problem is not knowing which risks are worth taking!

If you want to maximise the value you can add to your organisation complete our Risk Maturity Survey.

Upon completion of the survey you’ll know where you sit in terms of risk maturity and we’ll provide you with some advice around next steps.