Unprecedented decline in insurance premiums is over

Until late 2017, insurance market pricing had been in a state of decline for an unprecedented period of years, leading many to speculate that the traditional cycle is over. However, the claims environment changed dramatically in 2017 as natural catastrophes in the second half of the year, including hurricanes Harvey, Irma, Maria, earthquakes in Mexico, fires in California and a string of storm and flood events in Australia and Europe, combining to deliver significant losses and a drain on capital in the Property & Casualty insurance market.

Looking closer to home, a sustained period of low interest rates has had a significant impact in insurers results for a number of reasons:

- Insurers are required to maintain reserves for long-tail claims (e.g. liability). When interest rates are falling these reserves need to be ‘topped up’ as predicted investment returns have been impacted by lower than expected investment returns.

- Historically investment returns used to make up to 66% of insurers’ annual profits. This percentage has decreased to approximately 33% over the last few years. Last year investment returns reduced from 4.3% to 3.6%.

- The AU$ has not fluctuated much over the last 12 months and it is now hovering around the low 0.70c to 1 $US. This impact has been particularly noticeable in repair costs of motor vehicles that rely on replacement parts which are imported from overseas and for that matter on any building materials or equipment that is imported as part of a claim settlement.

- In the past decade or so the amount of losses held locally by insurance companies has increased. Previously any losses associated with a natural catastrophe event or individual losses over a set amount were picked up by their reinsurance arrangements, but today the threshold amounts before seeing reinsurance pick up losses have risen markedly. This means many smaller weather events, for example, aren’t falling into reinsurance treaties – and the local companies are picking up the losses to their net account. This is having a significant impact on local net loss ratios.

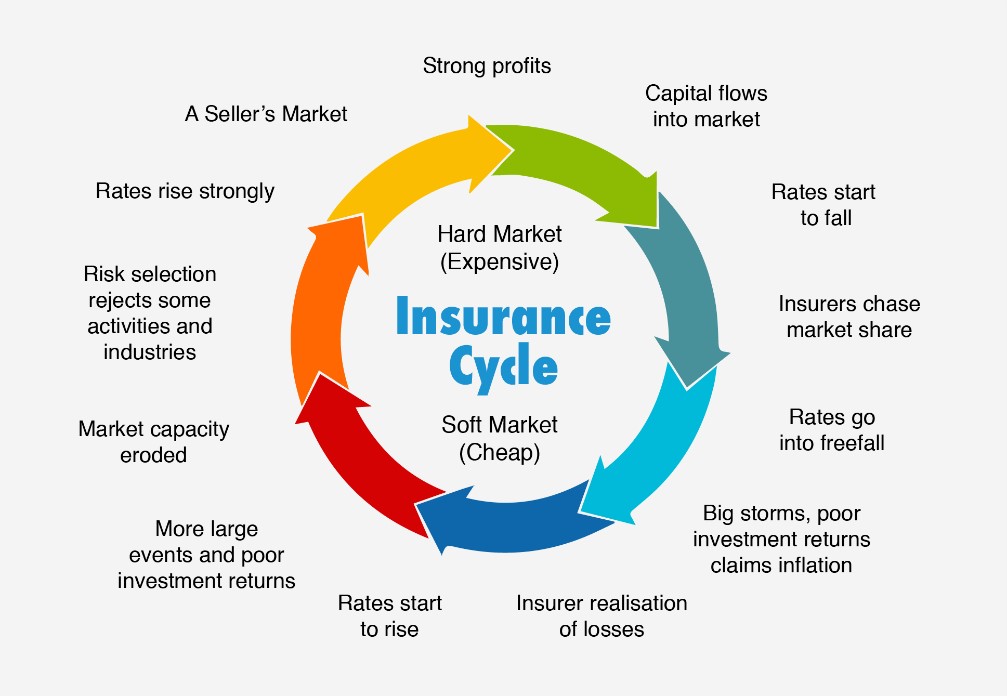

After weighing up all the factors, we believe we are seeing a period where some property risk types will find it difficult to find underwriters to either underwrite that risk or underwriters will reduce their capacity. Ultimately this will mean strong rate rises may be experienced. The insurance industry, we believe is hovering around 8 to 10 O’clock on the Insurance Clock pictured below, and property class rates will continue to rise to varying degrees depending on the risk type, claims history and your ability to manage risk.

There is still meaningful competition in the low-hazard major corporate account space. Premium rates are rising modestly as insurers take a more conservative view driven by a concern over potential competition. However, insurers are still looking to grow market share in this segment and therefore willing to compete on attractive accounts.

Conversely, high-hazard industries are experiencing a relatively harsh price correction. The food and beverage industry, which utilises the building material Expanded Polystyrene (EPS), is being heavily scrutinised, while market capacity has shrunk dramatically in response to a number of major fire losses. One major insurer estimates EPS fire claims over the past 15 years to have reached AUD 2 billion in Australia.

EPS has been an issue in the Australian market for many years with the emphasis mainly on the use of alternate building materials and the costly installation of fire protection via automatic sprinklers. While protective measures continue to play a role on pricing, some insurers have been forced to withdraw completely from this market. Consequently, local competition has disappeared, and capacity is now sought in Asia, London and Middle Eastern markets just to complete placements with medium to high policy limits.

We have been approached by numerous food and beverage companies over the last few months, whom have been unaware of the changing market conditions and consequently unprepared for the insurance outcomes that have been presented by their incumbent insurance broker.

With insurer’s increasing their focus on underwriting discipline and risk selection, differentiation will be key. In our view, insureds able to demonstrate that they have a strong Risk Management culture; robust Corporate Governance and a history of low claims are likely to be best positioned to obtain optimal outcomes.

This change in insurers’ focus are necessitating a refinement of renewal placement strategies, including:

- Starting the process much earlier than in previous years

- Supplying highly detailed information relating to risk protection and risk engineering needs

- Ensuring that policy limits and sub-limits are realistic and reflect the risk profile with awareness that there will be a cost associated with any unnecessary cover(s)

- Being prepared to consider higher deductibles or look to trade increased risk for premium reductions to mitigate the impact of market conditions

Above all, it’s crucial we work together to maintain policy terms and conditions even though prices are on the increase. After all, as our experience shows us time and again, price is ultimately forgotten when an insurable loss happens.

As we do not see the market changing for the foreseeable future, you need to start preparing now for your next renewal if you are going to achieve optimal outcome. If you want an independent insurance review undertaken, please contact Victual here.