By now I’m sure you have heard about the urgent national recall that was issued for pre-package lettuce and salad by Woolworths and Coles.

Because of the sheer size of the retailers they’ve been able to easily navigate the recall of this product and have been on the front foot with the public. Now, not all businesses have the same operating capacity as these giants, but it’s worth thinking about wether your business has the processes in place to survive a disaster of this magnitude.

Whilst the retailers have the resources to manage this issue, we hope their suppliers are able to. We work with many organisations that supply to the large retailers in Australia and a tool we use to help them understand where they are at is our risk maturity survey. In order to know how effective your risk management processes are and if you’ve got any gaps, you first need some context. What is your level of Risk Maturity and how do you compare to your peers?

We’ve surveyed more than 150 business owners from the Food and Beverage industry and what we’ve found is most people think they’re compliant when in reality they’re often risk immature! It’s the illusory superiority assumption coming into effect. After all, most people think they’re good drivers too.

Why you need to understand your Risk Maturity

Risk Maturity allows you to determine what areas of your business you should focus on and provides you with a framework for tailoring your risk processes and resources to meet these objectives.

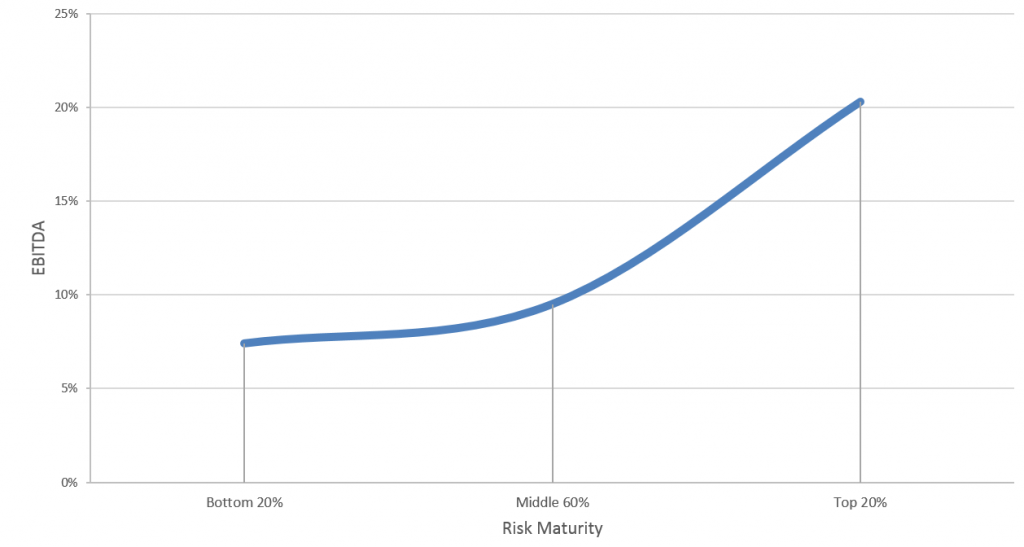

If this isn’t a priority for you, make it one. According to the United States Small Business Administration nearly 90% of businesses fail within two years of experiencing a disaster. If that isn’t incentive enough this article from Ernst and Young highlights the correlation between the level of integration and coordination across risk and financial performance. With the top 20% of companies generating three times the level of EBITDA as those in the bottom 20%.

Even if you haven’t got the correct risk management processes to stop a particular disaster, have you implemented the right protection moving forward? Ultimately, understanding your Risk Maturity is the first step towards arriving at a long-term, sustainable, risk management approach.

How confident are you that your business could survive a disaster? Just consider the fire which destroyed the Ingham’s processing plant. If this was your business would you have the protection in place to survive this catastrophe? Ingham’s managed such a catastrophe so well there was very little impact on their customers. In this respect it would seem’s Inghams are on the mature end of the spectrum.

How can I protect my business moving forward?

These are the four steps you can take to improve your risk management practices and develop confidence in your organisations approach to managing risk:

- Complete this Risk Maturity survey and develop an understanding of where you sit compared to your peers.

- Build a risk management plan that is achievable given the scale and risk profile of your business.

- Develop a proactive culture to understanding and managing risks across all areas of your business.

- Make an ongoing commitment to improving your risk maturity over time, and protecting the ongoing viability of the business.

Every business is going to be different, but the simple fact is a majority of businesses will never reach a point in their business where risk management is capable of adding value.

However, as long as you’re able to move beyond being merely compliant that is a great outcome. To do this you at least need to acknopwledge that a proactive approach to risk can add value to your business. Not only will you sleep better at night but you’ll create some competitive advantage for your organisation.

Next steps

If you’re unsure how to proceed with your risk management or you’re interested in comparing your organisation with your competitors, complete our Risk Maturity survey.

Already over 150 Food and Beverage business owners have completed the survey and begun their journey towards a tailored risk management approach.

Remember, Risk Maturity provides you with a framework for understanding the next steps you can take to protect your business. We’re not all “good drivers” and it’s best not to wait until an accident to discover that!